SportsView All

Quimby Selected To All-Citrus Conference First-Team

Lady Sharks point guard Shameir Quimby was selected to the Florida College System Athletic Association Citrus All-Conference First-Team. The freshman

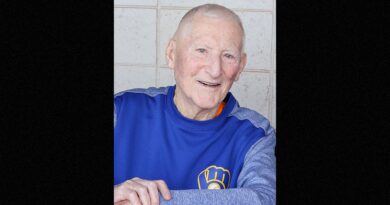

Architect Of Baseball Program At Kendall Campus Dies At 94

Baseball holds a special place in the hearts of South Floridians; it’s a symbol of national pride and community. At

Photo BriefingView All

NewsView All

After 31 Years In Prison, This Man Is A Semifinalist For $55,000 Scholarship

Eddie Fordham, Jr.’s future looked bleak as he sat in a suicide-watch cell at the Escambia County Jail while awaiting

Students To Launch Community Garden At Homestead Campus

When Jack Taks first set foot on Homestead Campus in August of 2022, he was surprised there was no on-campus

BriefingView All

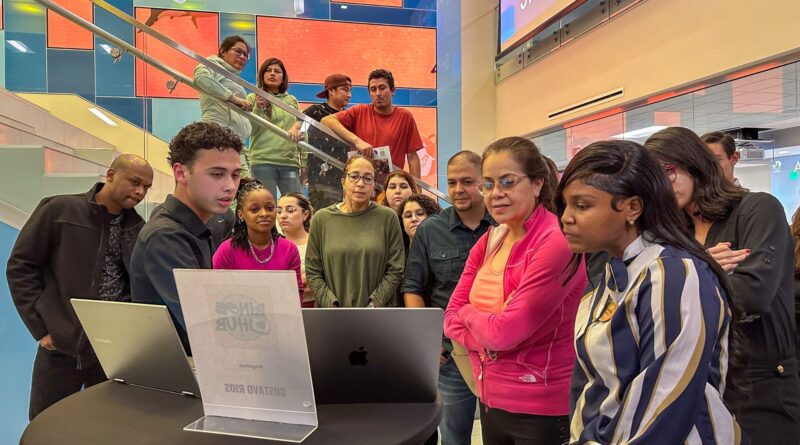

Two MDC Students Selected To Coca-Cola Academic Team

Jose Restrepo and Samantha Espinosa were named to the Coca-Cola Academic Team. The honor recognizes academic achievement, leadership and community

Quimby Selected To All-Citrus Conference First-Team

Lady Sharks point guard Shameir Quimby was selected to the Florida College System Athletic Association Citrus All-Conference First-Team. The freshman

Arts & EntertainmentView All

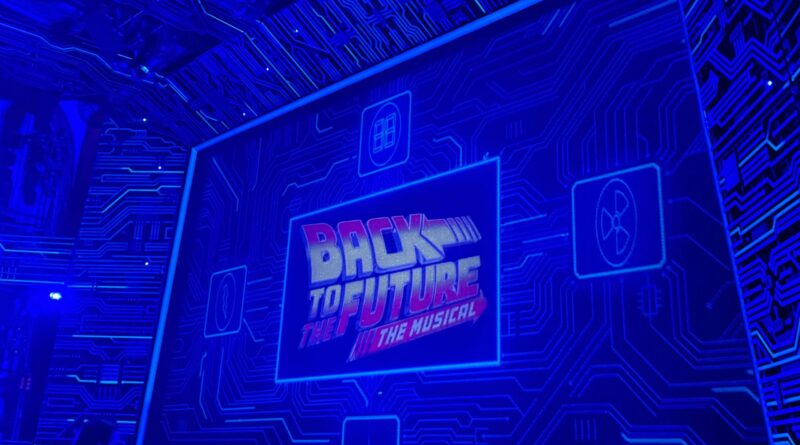

Back to the Future: The Musical Is a Broadway Must Watch

The Back to the Future franchise, with its three stellar movies, has created a global fan base since its original

ForumView All

Contrary To What Employers Believe, Gen Z Is Not Lazy

Gen Z is entering the workforce. According to a report by the World Economic Forum, more than 25 percent of